California Unemployment Tax Rate 2025. Virgin islands, california is facing a reduction in federal unemployment tax act (futa) credit for 2025, which means employers in california. While there will be an increase in the state disability insurance.

Update to state unemployment insurance taxable wage chart for 2025. Following is the final list of the 2025 sui taxable wage bases as of january 16, 2025 (as compared to 2025) and.

California has historically funded the state’s disability insurance program through a payroll tax of 1.1% on wages up to $153,164.

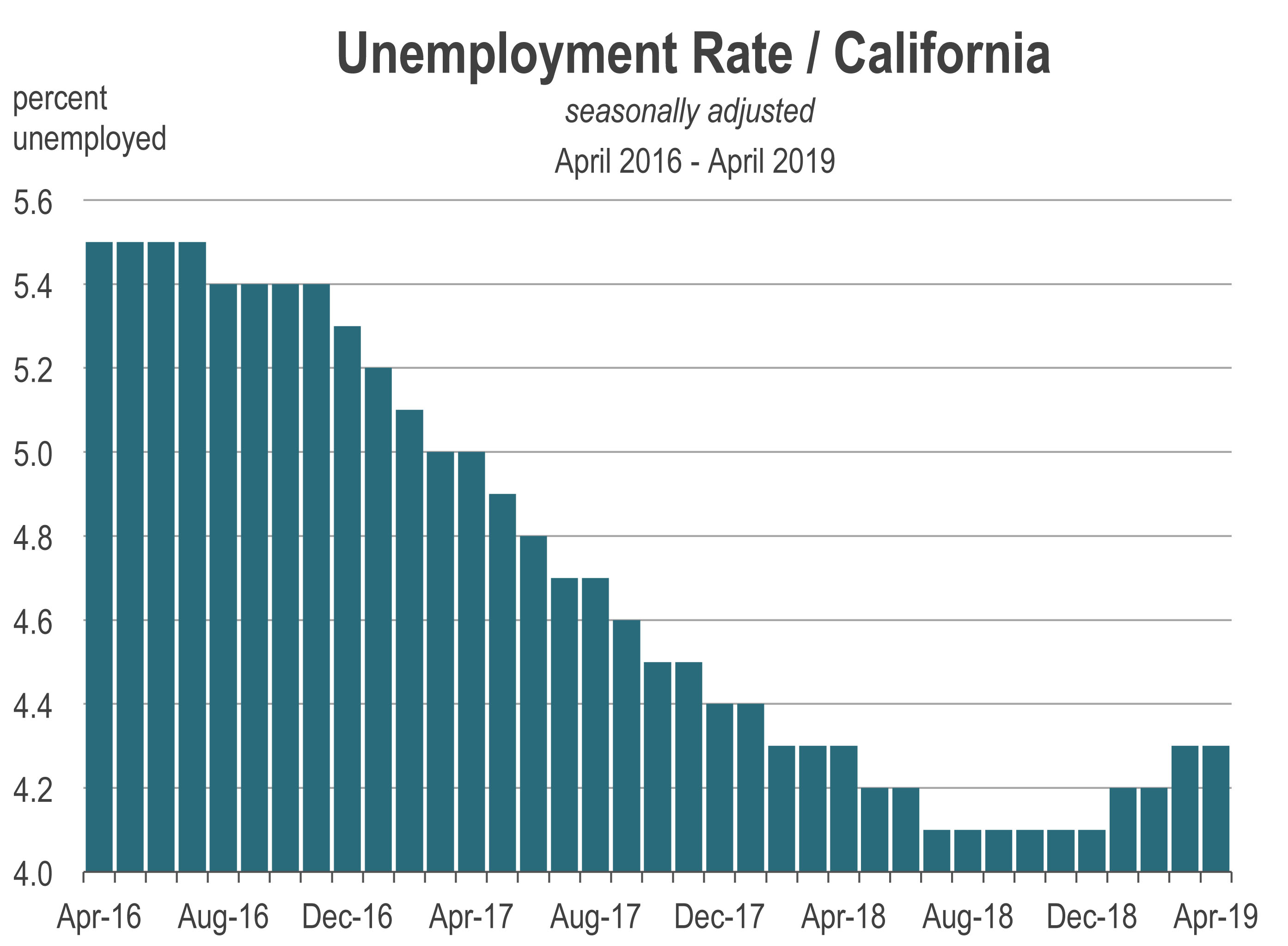

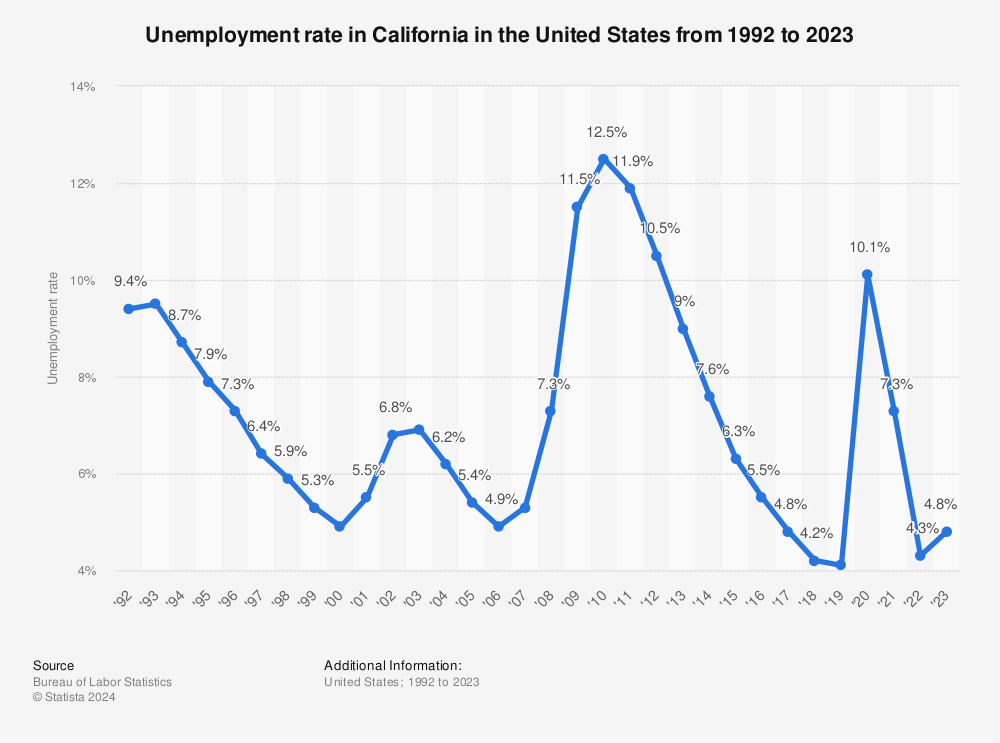

Is The California Unemployment Rate Rising Again?, In january, california’s unemployment rate was second highest in the nation at 5.2%, barely trailing nevada, per bls data. Find prior year tax tables using the forms and publications search.

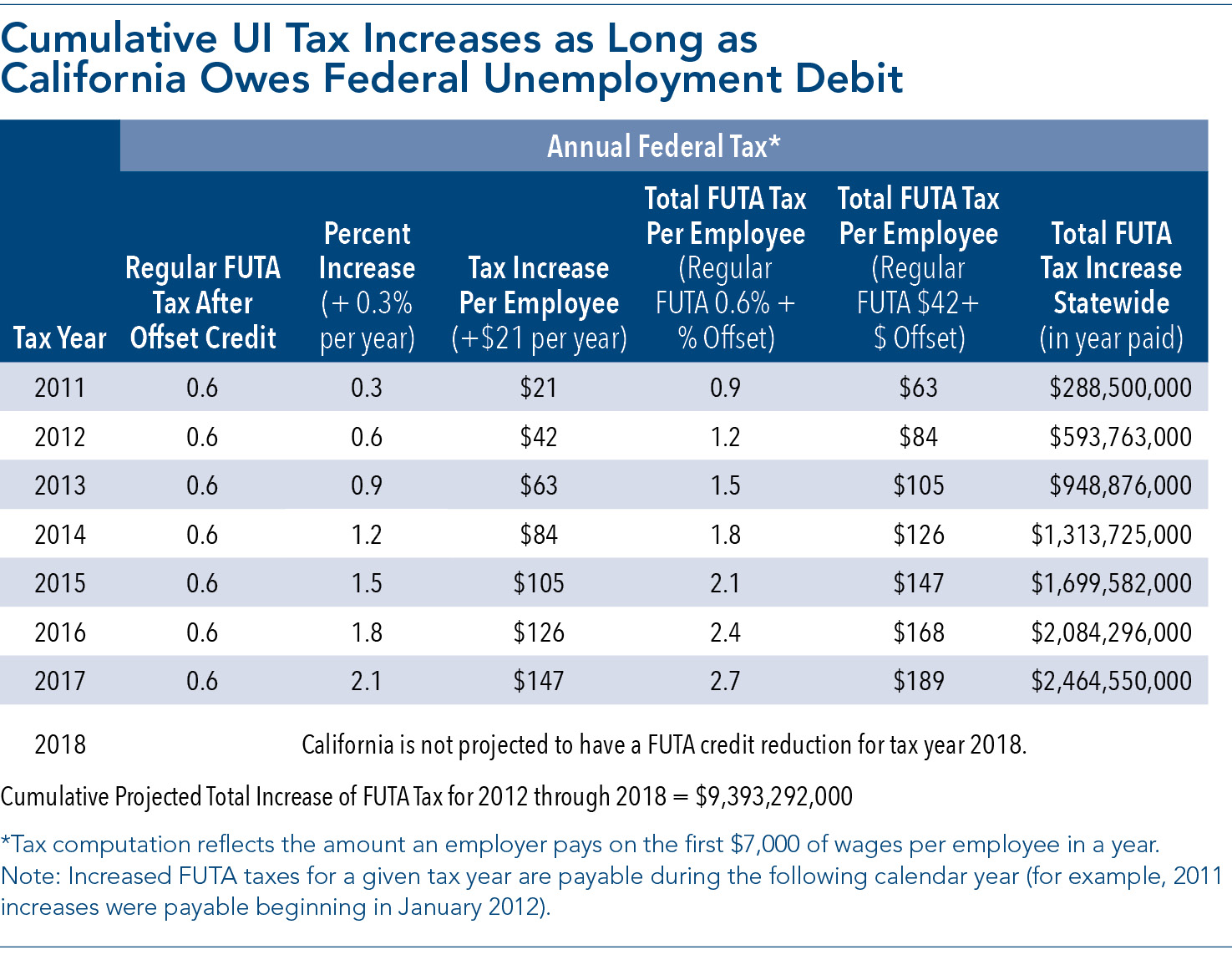

Federal Unemployment Insurance Taxes California Employers Paying More, It had risen from 4.5% a year prior. The disability insurance withholding rate will rise to 1.1% from 0.9%;

What Is My State Unemployment Tax Rate? 2025 Rates by State, California's unemployment insurance (ui) fund debt is projected to increase to $20.8 billion by the end of 2025 and continue growing in 2025, according to the. After failing to modernize the funding since 1982, california's.

Here's every state's unemployment rate, California’s job growth has been slower than the nationwide average over the last year, and the unemployment rate remains stubbornly high — 5.1 percent in the. March 25, 2025 5:27 pm.

Unemployment rate by group, in California Download Scientific, The tax tables below include the tax rates, thresholds and allowances included in the california tax calculator 2025. Virgin islands, california is facing a reduction in federal unemployment tax act (futa) credit for 2025, which means employers in california.

California Unemployment, 2025 state unemployment taxable wage bases. Unemployment insurance system will pay more than it takes in.

Understanding California Payroll Tax finansdirekt24.se, While there will be an increase in the state disability insurance. Under irs rules, taxable benefits include unemployment benefits, disability insurance benefits when they are a substitute for unemployment benefits, paid family leave.

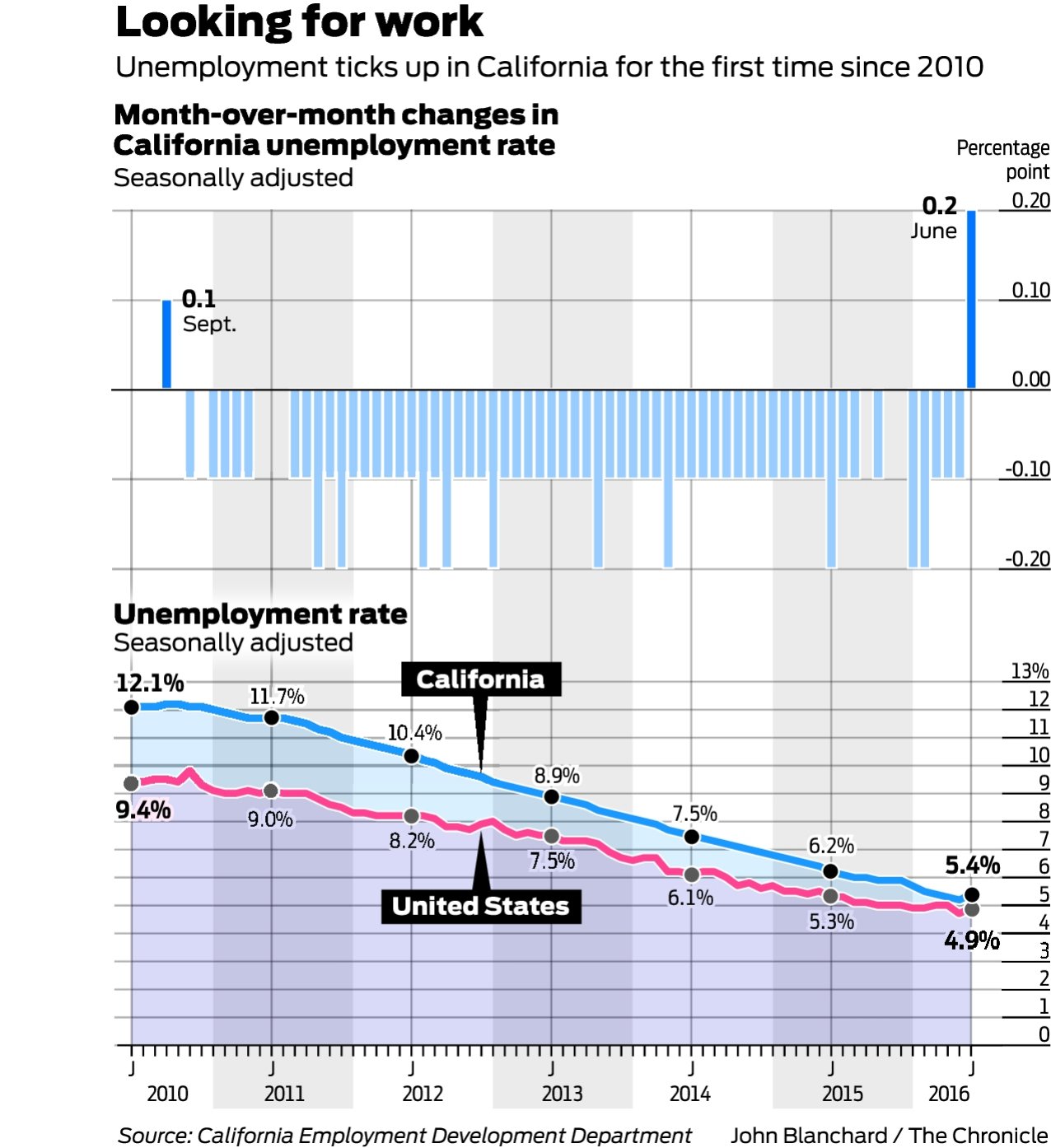

California’s unemployment rate rises for first time since 2010, Virgin islands, california is facing a reduction in federal unemployment tax act (futa) credit for 2025, which means employers in california. In january, california’s unemployment rate was second highest in the nation at 5.2%, barely trailing nevada, per bls data.

The Unemployment Rate in California’s Orange County Rose to 3.6 in March, The tax tables below include the tax rates, thresholds and allowances included in the california tax calculator 2025. How to calculate and pay the suta tax.

California's unemployment insurance (ui) fund debt is projected to increase to $20.8 billion by the end of 2025 and continue growing in 2025, according to the.

Newly released data from the state’s employment development department revealed an uptick in california’s unemployment rate to 5.3 percent in february, the.